nh food sales tax

2022 New Hampshire Sales Tax Table. A 9 tax is also assessed on motor.

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

The New Hampshire Sales Tax Handbook provides everything you need to understand the New Hampshire Sales Tax as a consumer or business owner including sales tax rates sales tax.

. A 9 tax is also assessed on motor vehicle rentals. If you know the division or bureau you are trying to reach dial one of following numbers. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

The sales tax in New Hampshire NH is presently 0. Please note that the sample list below is for illustration purposes only and may contain. Wayfair decision earlier this summer has stripped New Hampshire retailers.

As you can see to obtain a foodbeverage tax in New Hampshire FoodBeverage Tax you have to reach out to. 1-800-870-0285 email protected Sign In. A 7 tax on phone services.

Starting on October 1 2021 the meals and rooms tax rate was decreased. There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. Discovery Bureau 603 230-5086.

A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

Agency Partners in NH. The New Hampshire Food Bank fights the root causes of hunger by empowering people to learn new skills enabling them to become more self-sufficient and. Nh Food Tax Calculator.

New Hampshire Sales Tax Ranges. Any New Hampshire business contacted by a state or locality regarding the collection of sales or use tax is also encouraged to contact the DOJs Consumer Protection Bureau. Local Sales Tax Range.

LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax. The state does tax income from interest and. Combined Sales Tax Range.

Sales Affiliates and Partnerships. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Base State Sales Tax Rate.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

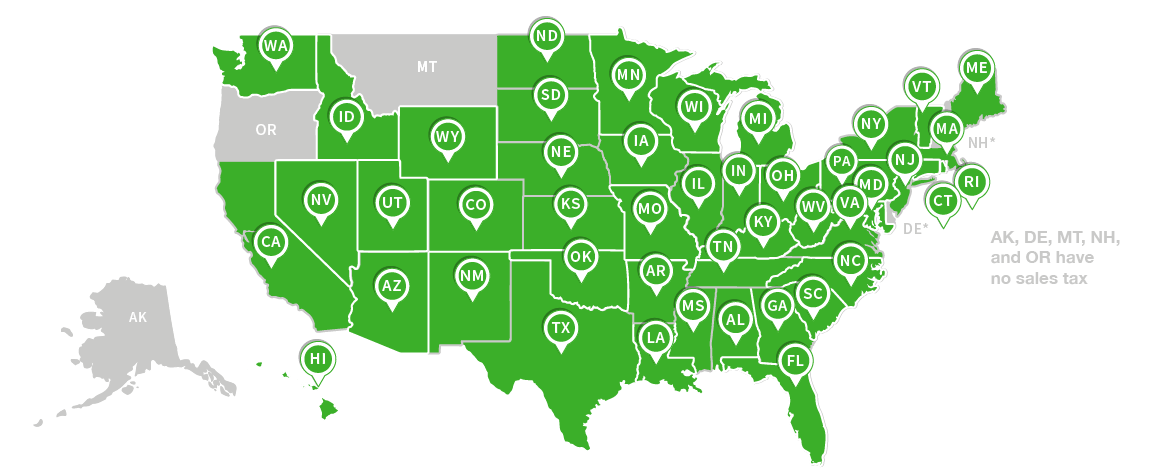

States Without Sales Tax Article

Amazon Sales Tax Everything You Need To Know Sellbrite

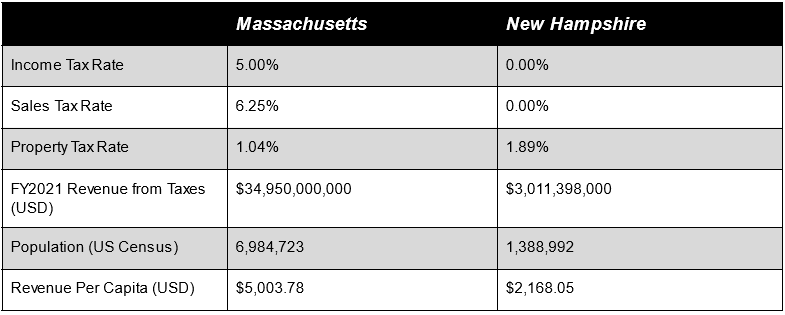

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

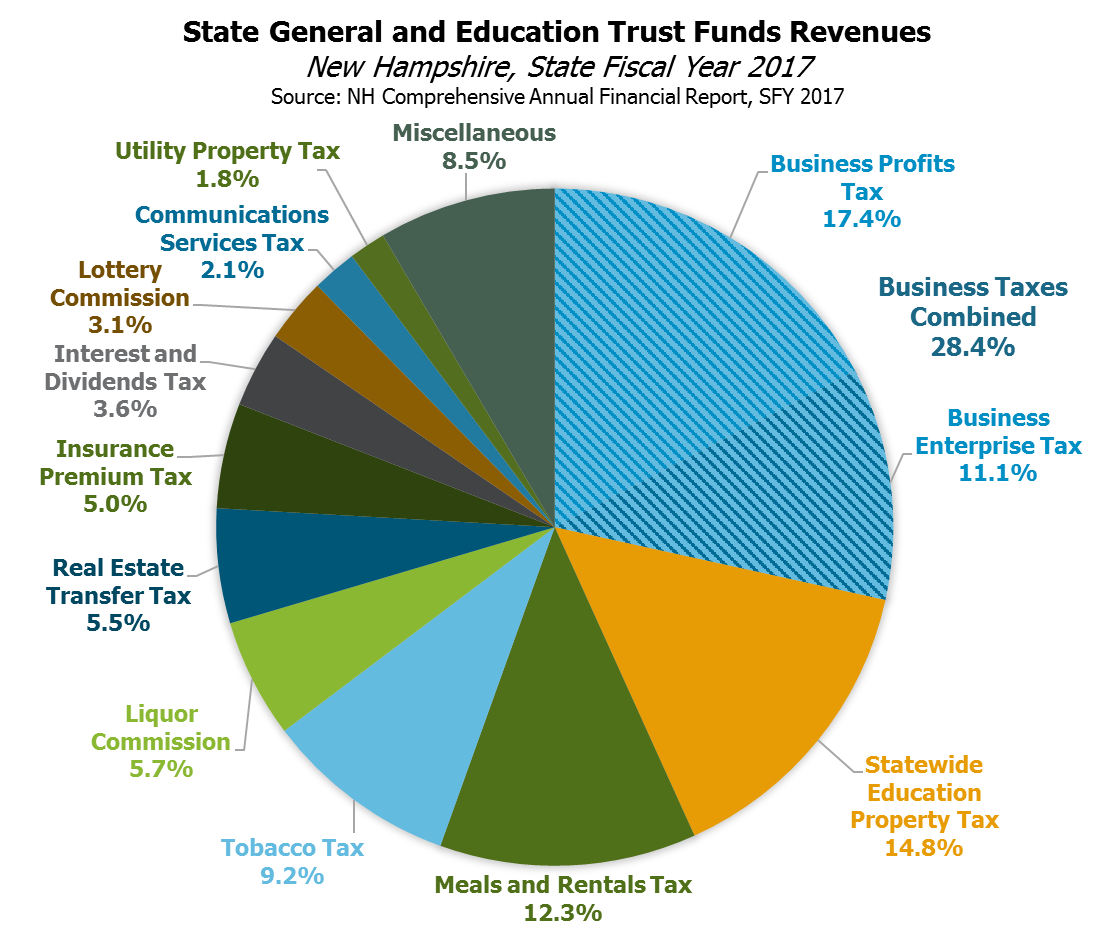

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Sales Tax Amnesty Programs By State Sales Tax Institute

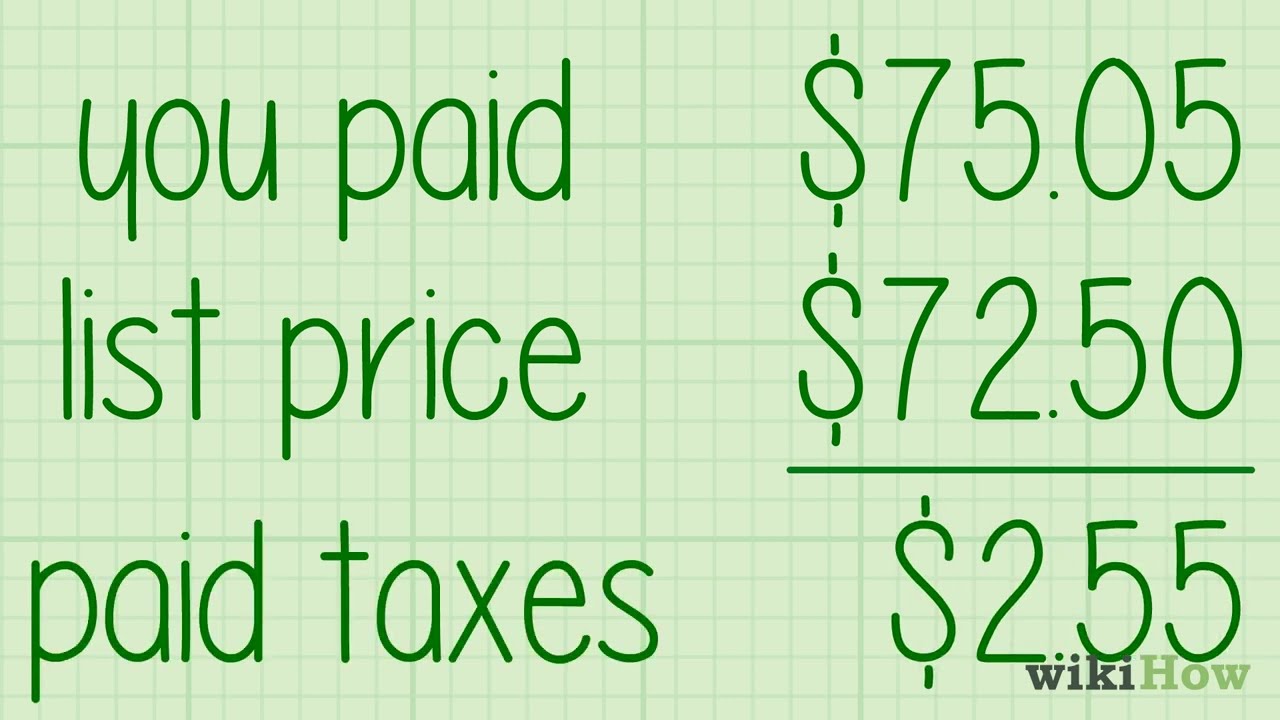

4 Ways To Calculate Sales Tax Wikihow

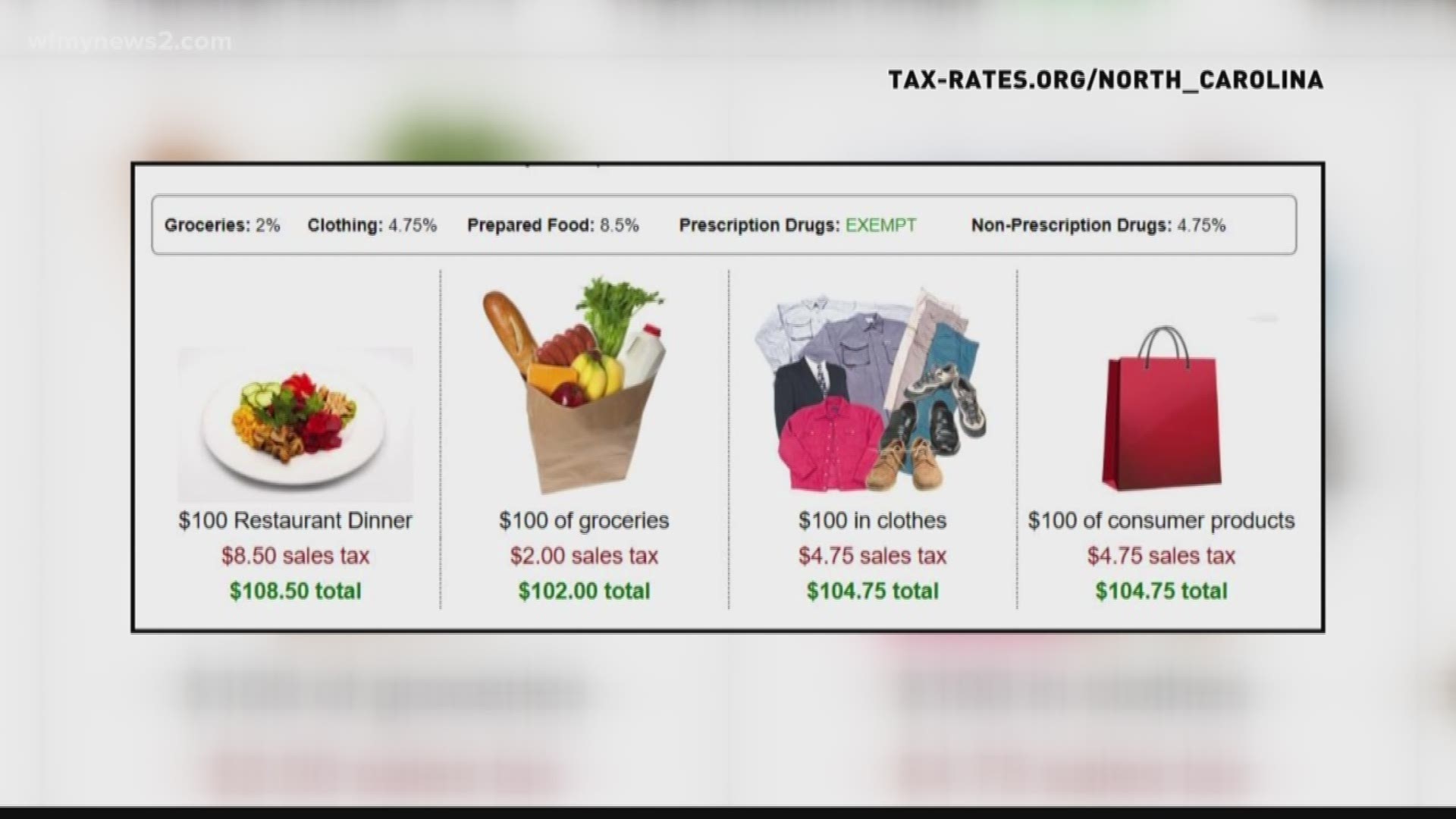

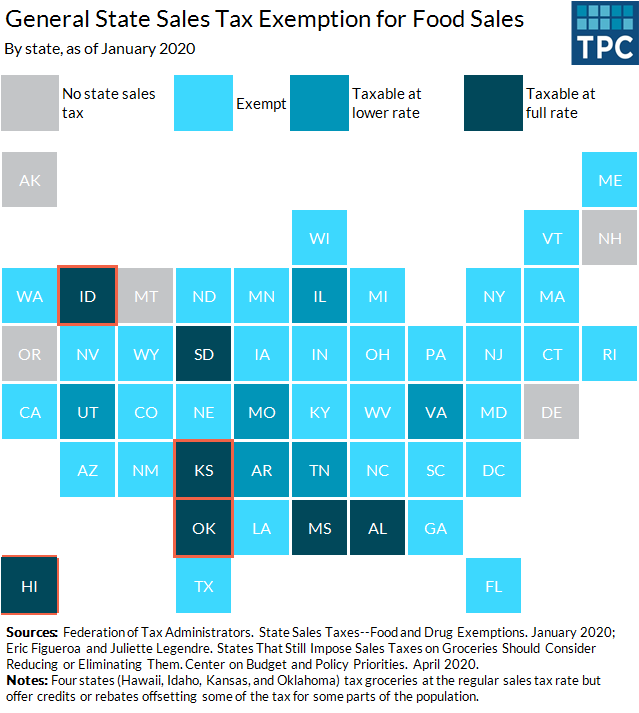

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

5 Sales Tax Questions Developers Should Ask Woocommerce Clients

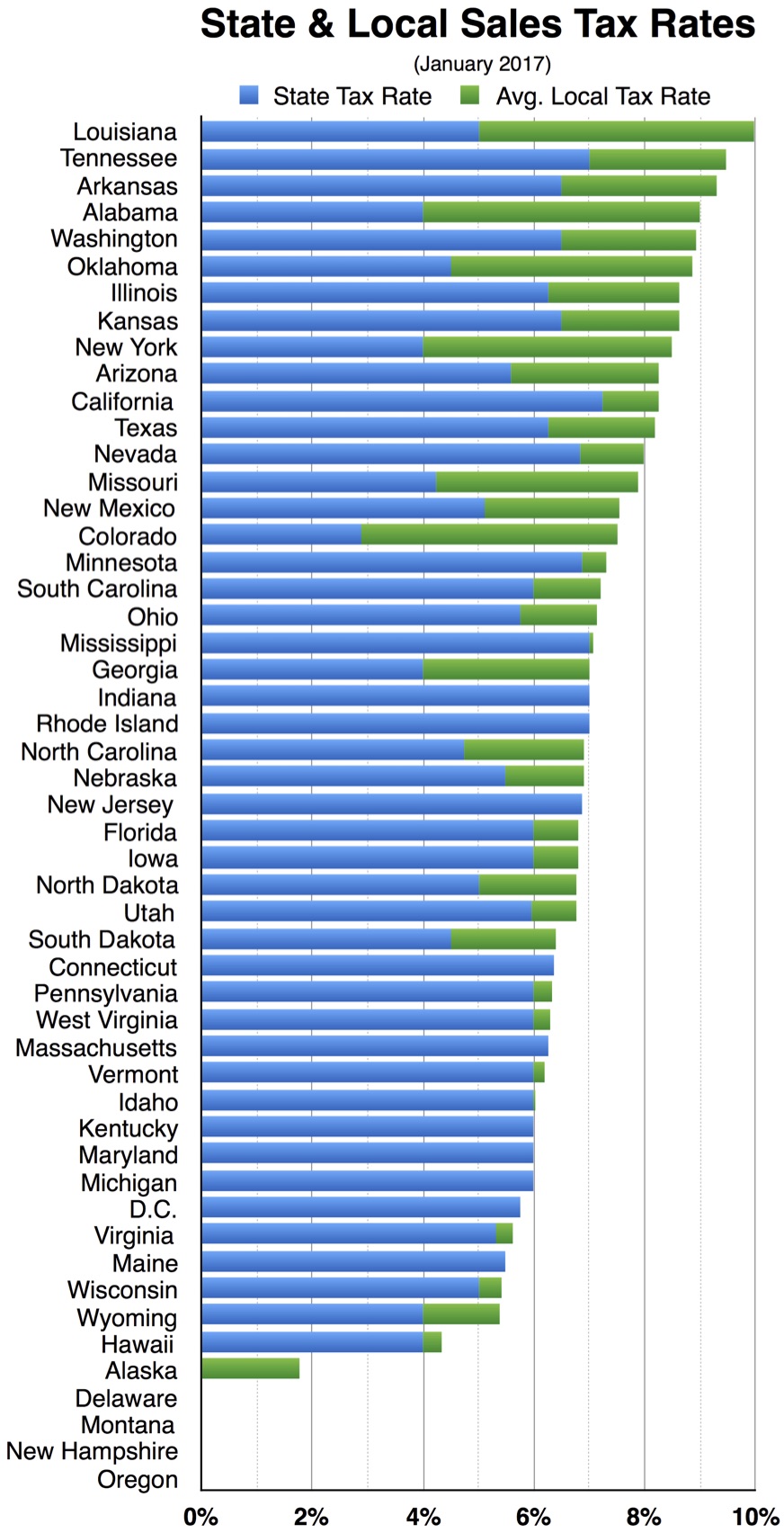

Sales Taxes In The United States Wikipedia

New Hampshire Restaurants And Food Businesses For Sale Bizbuysell

States Without Sales Tax Article

Sununu To Sign Bill Making Forgiven Ppp Loans Tax Exempt Nh Business Review

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

Mark Fernald Why Your Property Taxes Are So High

Bacon Me Crazy Hinsdale Nh Hinsdale Nh

Amazon Sales Tax Everything You Need To Know Sellbrite

Food Sales Tax Exemption Ff 08 10 2020 Tax Policy Center

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute